According to the statistics of relevant institutions, the market share of Chinese automobiles in Singapore 's new cars has risen sharply, reaching nearly 20 %. Among them, BYD even won the runner-up in brand sales in August.

、

、

In August 2024, Singapore 's new car sales increased by 55.4 % year-on-year to 3,949 units. From January to August, the cumulative sales volume was 26,442, an increase of 45.7 %.

Although Singapore 's auto market is smaller than Indonesia, Thailand and Malaysia, which sells millions of cars a year, and 800,000 cars a year, it has the significance of the market in Southeast Asia. Consumers in many countries will refer to Singapore 's auto sales trends. Therefore, in the process of Chinese automobiles entering the Southeast Asian market, Singapore is a ' small but influential ' stop.

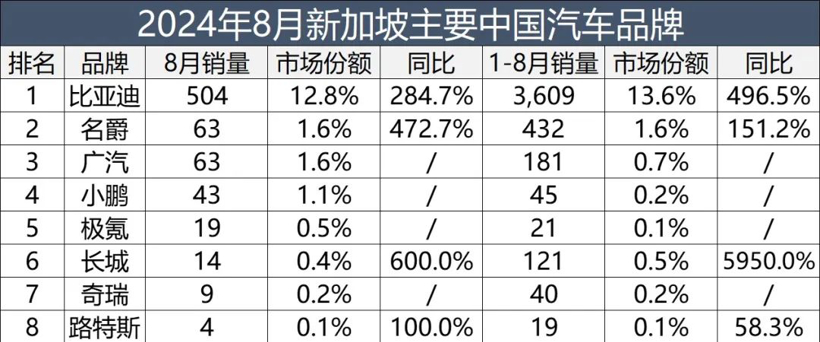

Since this year, Chinese automobiles have made great progress in Singapore. In August, BYD achieved 504 vehicles, second only to Toyota 's 566 vehicles, and the gap is not large. When Toyota fell 3.1 % year-on-year, BYD surged 284.7 %. The cumulative sales of Toyota and BYD in the previous 8 months were 4,383 and 3,609 respectively. BYD already has the strength to compete for the title.

At the same time, SAIC 's Singapore sales are also picking up rapidly, with August sales up 472.7 % year-on-year. Guangzhou Automobile, which has similar sales volume with the famous automobile brand, has begun to occupy 1.6 % of the market share, although it is a new automobile brand. These two brands have entered the Singapore automobile brand sales TOP20 rankings.

Most of other Chinese auto brands such as Xiaopeng, Krypton, Great Wall, Chery and Lutes ( which are classified as Chinese by parent company Geely ) have achieved a year-on-year surge or new entry into the Singapore market.

According to the statistics of the automobile commune, the total sales volume of Chinese brands in Singapore in August was 719, with a market share of 18.2 %. In the first 8 months, it sold 4,468 vehicles, with a market share of 16.9 %.

Under the shape, the Japanese car market share in Singapore has been diluted by Chinese brands, and Japanese car brand sales growth rate is not as good as Chinese cars. Tesla 's performance in Singapore is not as good as China 's new energy vehicles. In the first half of this year, Tesla sold 969 vehicles in Singapore, only 28 more than the same period last year. Tesla sold 1,451 vehicles in January-August, less than half of BYD 's total.

Singapore is a wealthy island country with a population of only 5.9 million people. The car tax rate is the highest in the world. Car owners must purchase a certificate at a cost of about S $ 100,000 ( US $ 74,000 ). Therefore, in fact, the price difference between BYD and Tesla in Singapore is not much, and Chinese automobile brands cannot win in Singapore by relying solely on price advantages. They can achieve today 's results, and rely more on product strength and marketing capabilities.

Taking BYD as an example, in addition to product strength, it also focuses on marketing efforts in Singapore, and has opened two restaurants in the city 's exhibition halls. Consumers can go to taste dishes inspired by their models and book a test drive.

In addition, Singapore 's promotion of automobile electrification is beneficial to Chinese automobiles. The country plans to stop selling internal combustion engine vehicles from 2030. At present, electric vehicles account for one-third of Singapore 's auto market.

Singapore is a bellwether for the Southeast Asian auto market. Just as Tesla has lagged behind China in Singapore, its momentum across Southeast Asia has been weighed down.

In Southeast Asia, Tesla 's market share fell from 6 per cent in the same period last year to 4 per cent in the first quarter of this year, according to the latest data from research firm Counterpoint, although the overall electric vehicle market grew by 37 per cent over the same period.

、

、