Recently, Great Wall Motors released its financial report for the third quarter of 2024, with profits exceeding 3 billion yuan for three consecutive quarters and a relatively stable performance foundation.

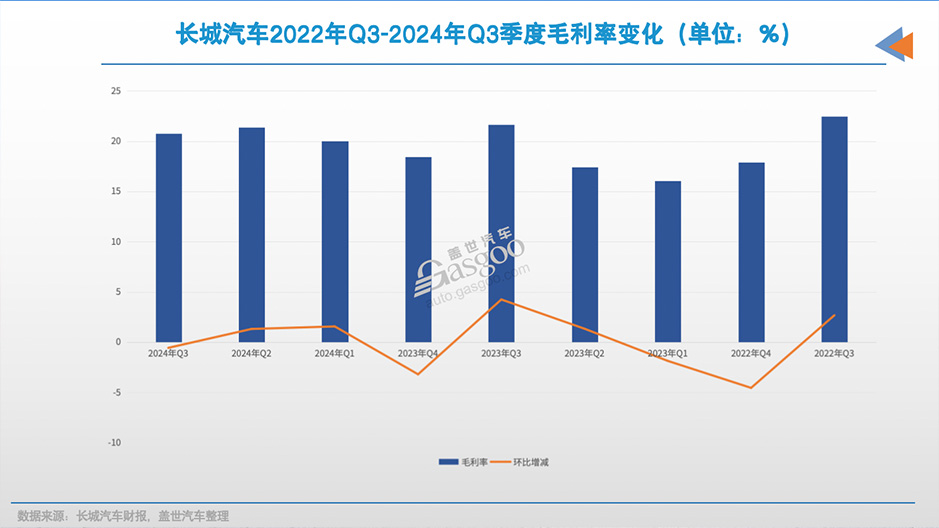

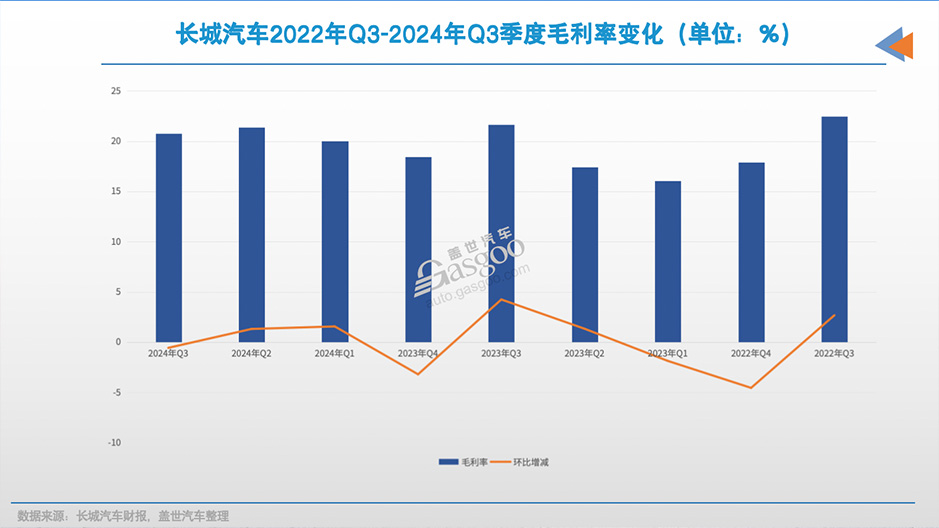

Specifically, during the reporting period, Great Wall Motors achieved a revenue of 50.825 billion yuan, with year-on-year and month on month growth; The net profit attributable to the parent company was 3.35 billion yuan, exceeding 3 billion yuan for three consecutive quarters. The gross profit of the entire vehicle has once again exceeded 20%, comparable to traditional luxury brands such as BBA.

This achievement is mainly due to two growth engines: one is the strong performance of tank brands, with sales continuing to rise; The second is the vigorous development of overseas business, which contributes considerable revenue to Great Wall Motors.

Tanks, becoming the cornerstone of profitability?

In the third quarter, Great Wall Motors sold 294100 new cars, a month on month increase of 3.45%; Among them, the sales of new energy vehicles reached 79100 units, a year-on-year increase of 2.59%.

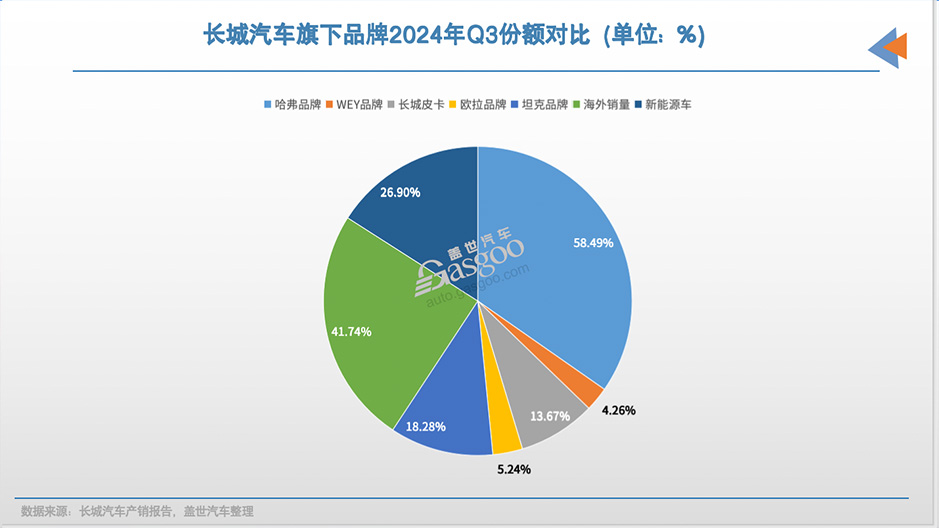

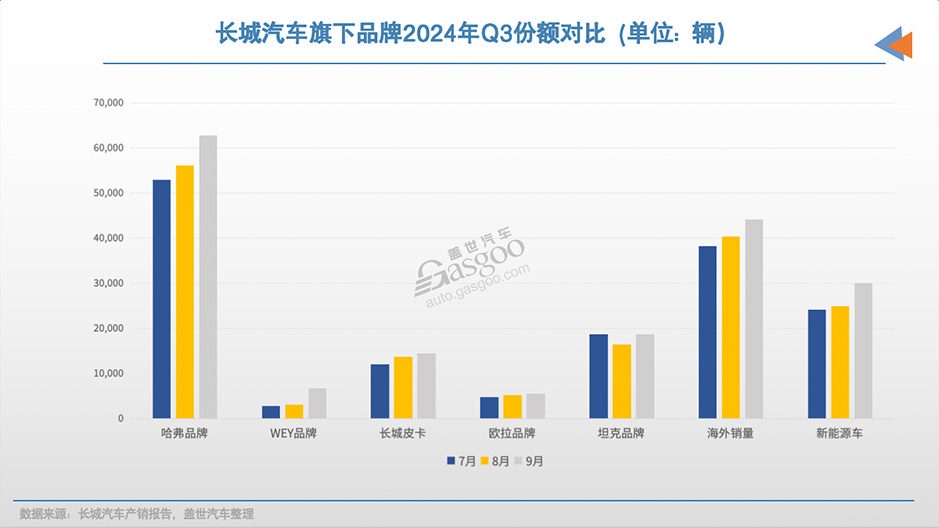

From the brand matrix perspective, each sector shows a trend of differentiated growth: the Haval brand continues its dominant position, with quarterly sales reaching 172000 vehicles, accounting for nearly 60% of total sales. The new Haval Raptors continue to strengthen, while the traditional flagship model H6 Classic Edition maintains steady performance. It is worth mentioning that the second-generation Haval H9, which was just launched at the end of October, is currently in high demand. Within 5 days of its launch, more than 500 units have been delivered, with over 6000 pending orders.

Tank brands continue to grow in volume, with sales reaching 54000 units in the third quarter, accounting for 18% of total sales. Although it has not yet surpassed Haval in terms of volume, its high gross profit attribute makes it a backbone of the company's profitability. This can be seen from the overall gross profit margin of Great Wall Motors increasing by 1.8 percentage points to 20.8% in the third quarter.

According to analysis by Guolian Securities, Great Wall Motors sold 212000 vehicles worth over 200000 yuan in the first three quarters, a year-on-year increase of 39%. Among them, the sales of the Wei brand and Tank brand increased to 23.7%, an increase of 7.8 percentage points compared to the same period last year, confirming the success of its high-end strategy.

In terms of Wei brand, it achieved sales of 13000 vehicles in the third quarter. The newly launched Blue Mountain has performed quite well, with monthly sales exceeding 6108 units, a year-on-year increase of over 200%. Since its launch, its cumulative sales have exceeded 10000 units. It is worth noting that the all-new Blue Mountain is accelerating its urban NOA layout, currently covering 9 key cities including Baoding, Chengdu, and Chongqing.

The other two major brands, Great Wall Pickup and Ora, sold a total of 56000 vehicles in the third quarter, which also performed well.

Overseas markets, second growth curve

Overseas markets have become the second curve of Great Wall Motors' sales growth. In the third quarter alone, Great Wall Motors' overseas sales reached 123000 vehicles, a year-on-year increase of 39.85% and a month on month increase of 12.90%, contributing 40% to the group. Among them, 44000 units were sold overseas in September, once again breaking the monthly overseas sales record.

It is reported that Great Wall Motors currently has over 14 million global users and more than 1300 overseas sales channels, with cumulative overseas sales exceeding 1.7 million vehicles.

In terms of product layout, Great Wall Motors continued to expand its overseas market territory in the third quarter. Haval Big Dog enters the Uzbekistan market, and Weipai Gaoshan begins exporting to Europe. Tank brands have implemented a multi-point layout - Tank 300 has been launched in Malaysia and Azerbaijan, and Tank 500 has entered the Chilean market. At the same time, Euler Cat landed in Qatar and Uruguay, and the Great Wall Cannon also entered the markets of Mexico and Uruguay.

The localization strategy of production is steadily advancing. Great Wall Motors and Vietnam Cheng'an Group signed a memorandum of cooperation to launch CKD mode cooperation; Signed a memorandum of understanding with Senegalese distributors regarding the KD project. In addition, CKD projects in Malaysia and Indonesia have been officially put into operation.

Analysts from Minsheng Securities stated that by leveraging localized production in overseas markets such as Thailand and Brazil, they believe that Great Wall Motors' fuel and hybrid products have high-quality product capabilities and are highly competitive in overseas markets. They are optimistic about the company's accelerated overseas layout, which will lead to sustained sales growth.

The growth of tank brands and overseas business has driven the optimization of product structure. In the third quarter, Great Wall Motors' bicycle revenue reached 173000 yuan, a year-on-year increase of 20%. This is the main reason why its profits can maintain stable growth despite the slowdown in sales growth. Regarding this, Great Wall Motors stated that profit growth comes from the improvement of product strength, rather than "refusing to give up profits". Great Wall Motors continues to increase its R&D investment, with R&D expenditures exceeding 11 billion yuan in 2023, and will maintain a high level of investment in 2024.

In the field of intelligence, Great Wall Motors has launched a new generation of Coffee Pilot Ultra intelligent driving system, achieving high-precision map free all scene NOA; The new generation Coffee OS 3 smart space system enhances personalized experience through AI technology. In September, its self-developed RISC-V automotive grade MCU chip, the Zijing M100, was completed and lit up,Accelerate the integration of software and hardware intelligence.

Currently, advanced intelligent driving has gradually become one of the important considerations for consumers when buying a car. Analysts from Guolian Securities believe that Great Wall Motors is actively investing in advanced intelligent driving research and development, and will gradually equip other models of brands such as Wei and Tank with advanced functions such as NOA, which is expected to further enhance brand competitiveness and help the company's sales growth.